In a world where time is money and mindset is currency, investing is no longer optional, it’s an essential. Whether you’re a fresh graduate in your first job or a seasoned professional leading a team, the question isn’t “Should I invest?” It’s “How do I invest better this year?” Let’s be real—2025 isn’t a year of “let’s wait and watch.” In an era that’s changing by the quarter, the idea of “smart investing” has become non negotiable. Whether you’re a 24 year old analyst just decoding your first payslip, a 30 year old project lead saving aggressively, or a CEO recalibrating your goals; investment strategies this year will define how resilient your financial future really is going to be.

So let’s unpack what the smartest professionals are doing with their money this year and why you need to be doing it too.

What’s Driving Investment Trends in 2025?

This year, the investment strategies will be evolving faster and it’s not just about chasing returns now. Global inflation still plays a tricky stand, and central banks are adjusting interest rates with caution. But savvy investors aren’t just waiting around right? they watch and plan smart. This is an era to stay informed, adapt quickly, and make intentional choices that align with the bigger picture, not just the short-term buzz.

But what’s fueling that big picture?

Tech accelerations are leading the charge with AI, blockchain, and clean energy aren’t just headlines, they’re driving serious value. At the same time, younger professionals are showing up with a purpose many growing up realise they lacked, demanding investments that match their ethics and modern day values. Adding in the rise of remote work and freelancing freedom, and you’ve got a generational gap, reshaping how personal wealth has been built over the years. Investing today isn’t one-size-fits-all. It’s personal, mindful, and future forward.

Top Investment Strategies That Professionals Swear By Today

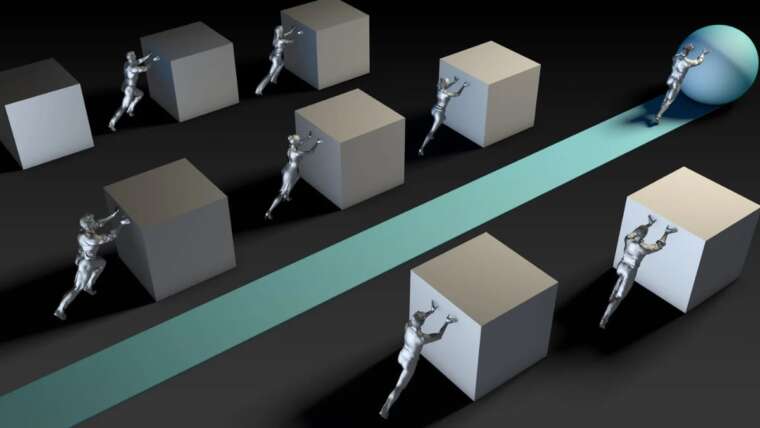

1. Mindful Investing and Strategic Resilience

Self development begins with self discipline and investing is no different. This year, one of the most powerful shifts we’re seeing is toward mindful investing, where emotional intelligence deems to urgency of financial planning.

This aligns perfectly with our brand Manifestopedia’s belief in self-adherence. By investing based on your long-term vision, values, and risk tolerance, you’re not just growing money—you’re growing internal trust and a conscious control.

No more blindly copying trends or acting on impulse. Mindful investors now prioritize–

- Companies aligned with their values and resilience (think ESG or sustainable portfolios)

- Investments that don’t just offer returns, but resonance too!

- Emotional check-ins before decision making

2. Diversify Your Investment Portfolio

The old school wisdom of diversifying your portfolio still stands—but in 2025, it’s all about diversification with a modern twist. Today’s market savvy professionals are looking beyond traditional options. Here’s what makes up a future proof portfolio–

- Index Funds & ETFs: Still the safest bet for long-term growth

- Digital Assets: Crypto, tokenized assets, or digital real estate (with risk awareness)

- Alternative Investments: Art, collectibles, fractional ownership

- Sustainable Businesses: Crowdfunding or equity in startups with strong ESG principles

So what’s the goal now?

Build a portfolio that protects, performs, and progresses with the world.

The key is not to overextend but to choose a mix that reflects both your growth ambition and your peace of mind.

3. Automate, Strategize & Elevate Investment Disciplines

One truth stands strong though. Consistency beats intensity.

And what better way to stay consistent than automation for an era like ours?

Robo advisors, automatic contributions, AI backed insights.. these aren’t just tools! They’re your silent mentors. Here’s how professionals are leveraging automation–

- Set-and-forget contributions to mutual funds or SIPs

- Auto alerts for stock market trends based on personal goals

- AI wealth dashboards that give mental clarity through data

The less emotional clutter around money, the more empowered your mindset becomes.

Remember “systems breed success.”

Automation is your spiritual discipline disguised as financial structure!

4. Build an Emergency Investment Buffer Strategy

No, it’s not just a savings account. Build a short-term bond ladder or keep a portion in ultra-liquid mutual funds.

Emergency funds need to earn something while they sit.

This is how you protect your investments from unexpected exits.

You’re Not Just Building Wealth, You’re Building Freedom

You don’t need to be a finance guru. You need –

- Clarity: What are your financial goals—freedom, family, a legacy!

- Consistency: Invest small, but invest regularly. Compound interest loves discipline.

- Curiosity: Stay updated, learn the language of money. Read, follow, ask.

Before you allocate capital to the outside world, allocate energy inward. The highest-return investment is still you. In 2025, smart professionals aren’t chasing markets—they’re nurturing the asset within.

The best thing about investing in 2025? It’s not just about becoming rich. It’s about becoming free—to choose your work, your city, your time, and your impact.

Nobody, literally. No investor, no fresher, no real time Billionaire today, started with all the answers in pocket. They just started it. You only live once, might as well experiment here and there!

Every financial decision today is a vote for the life you want tomorrow. Make it count. Be informed. Be intentional. And most of all, be unafraid. it is all “Yours.”

Author’s Note:

This article is developed as part of Manifestopedia’s strategic content ecosystem, which aims to align personal transformation with entrepreneurial and corporate growth. The insights presented herein are curated through a behavioral-finance lens, combining market data trends with cognitive productivity frameworks to ensure actionable relevance. The goal is to offer high value, SEO optimized, and psychologically attuned content that supports the financial literacy and mindful decision-making of high-performing professionals. All the investment strategies discussed reflect a balanced perspective of risk, sustainability, and long-term value generation—consistent with Manifestopedia’s self discipline and growth centered philosophy.

One Response

Comments are closed.